Yield Farming vs Staking

In the world of decentralized finance (DeFi), many are drawn to the prospects of earning passive income through yield farming or staking. Both methods promise attractive returns, but how do they differ?

This guide aims to demystify these concepts, providing insights into staking vs more complex yield farming in crypto and their merits. From understanding the basics of crypto farming vs staking to exploring the intricacies of liquidity pools, we will help you make informed decisions in the world of DeFi.

What is Yield Farming?

DeFi yield farming, at its core, is the practice of locking up assets in a DeFi protocol to earn rewards, typically in the form of additional tokens. Yield farming is akin to traditional farming – one sows seeds (crypto assets) into the fertile ground (DeFi protocols) and in return, harvests crops (rewards).

This process can be seen in various forms, from general liquidity mining to proof-of-stake participation and engaging with lending protocols. The main point to remember is this, yield farming represents any sort of DeFi activity where you earn a return. There are many different types of activities, and they all fall under this large umbrella.

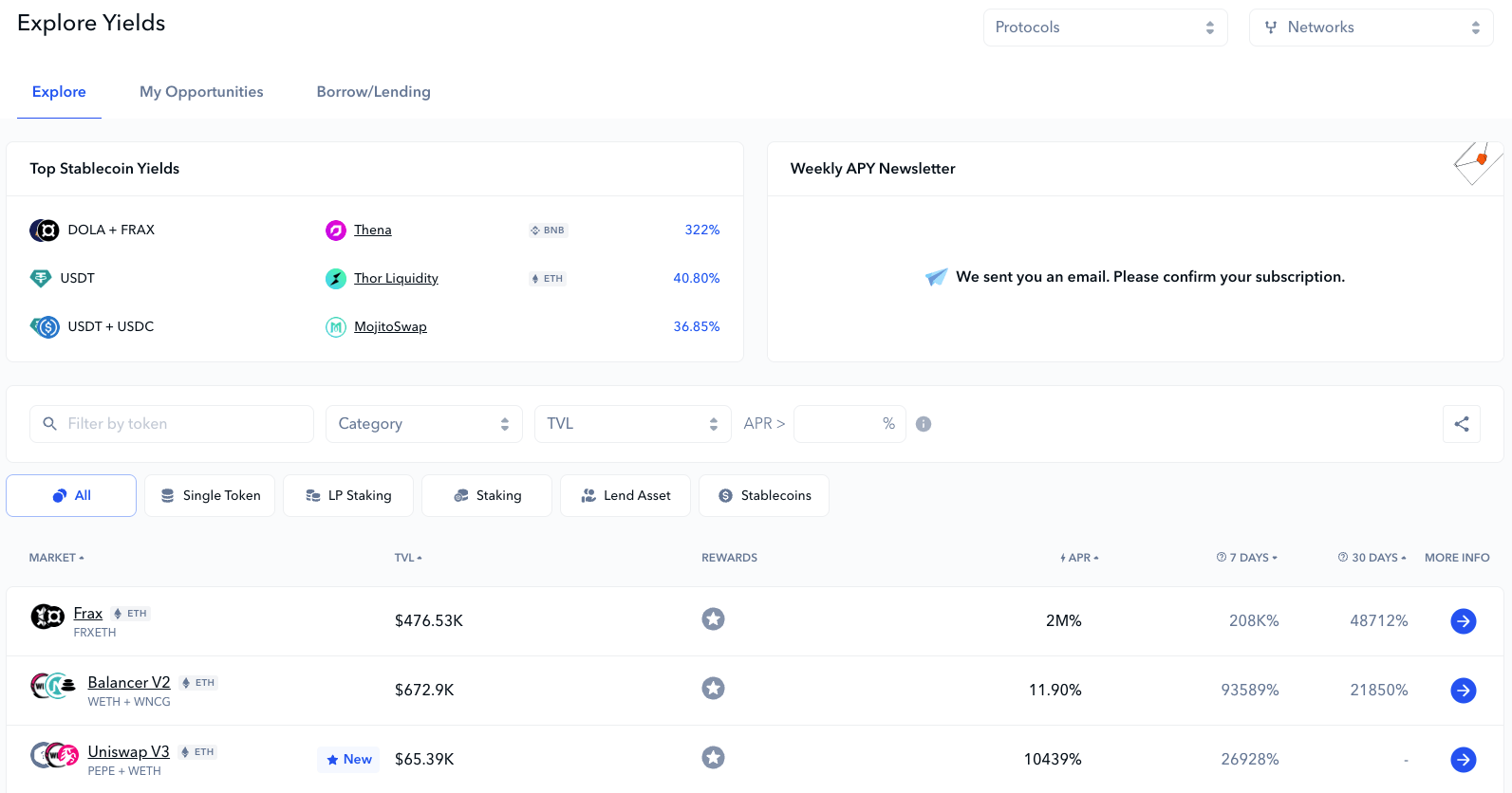

The De.Fi Explore tool helps you find the industry’s best yield farming rates

While yield farming offers attractive rewards, it’s also associated with certain risks. The success of farming depends on fluctuating market conditions, contract vulnerabilities, and the tokenomics of the reward token.

What is Staking?

In the world of decentralized finance, staking is one of the most popular types of yield farming. Essentially, staking involves locking up a certain amount of cryptocurrency in return for payments of crypto in return.

While staking can have many different implementations, it’s important to remember that it is just one type of yield farming. Subsequently, under the umbrella of staking, there are two prevalent types:

Proof-of-stake staking: Here, individuals lock their tokens to secure proof-of-stake blockchains like Ethereum, Cardano, or Solana. The staked tokens help in transaction validation and securing the network. While participants still receive payments for securing the network, this form of staking is more about network security than earning rewards.

Staking for DeFi rewards: This is a simpler act of staking, where individuals lock coins solely to receive rewards. Unlike the previous type, this farming and staking crypto method doesn’t secure a network. The user is simply locking tokens in a smart contract, usually in return for some other type of reward provided by an app or protocol.

Examples of Yield Farming

Yield farming offers diverse avenues for earning, from liquidity pools to staking to DeFi lending. Here’s a closer look at some popular methods:

Liquidity Mining (LP Staking)

Liquidity mining refers to providing liquidity to decentralized exchanges. Users deposit an equivalent value of two tokens in a liquidity pool, facilitating token trades for automated market maker (AMM) systems. In return for providing liquidity, they earn a portion of the trading fees as well as potential rewards in the form of governance tokens.

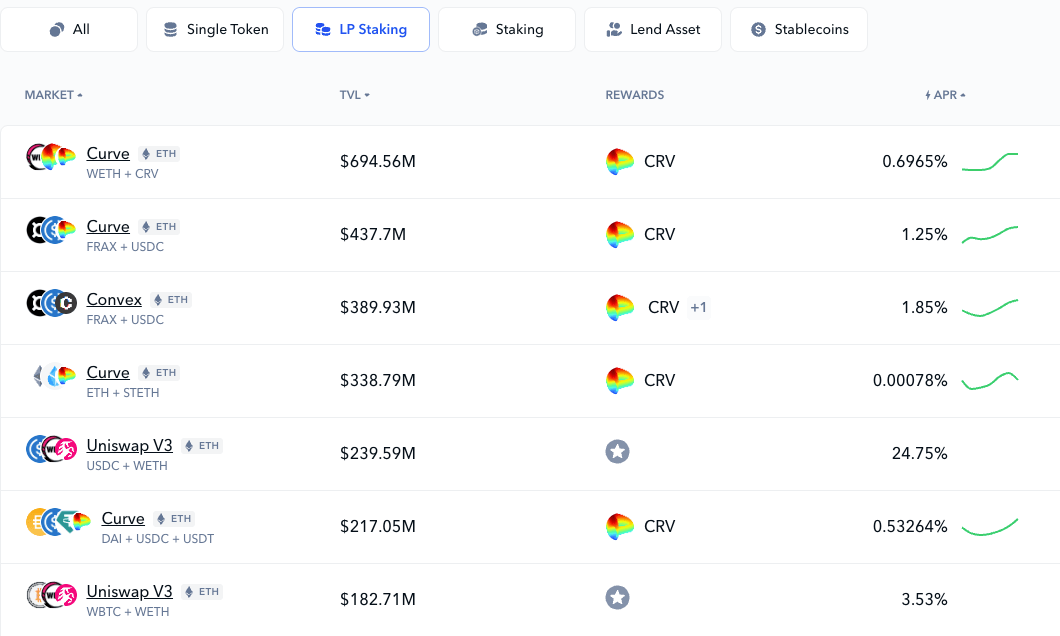

Filtering for LP Staking within the Explore tool allows you to browse the best opportunities across DeFi

While lucrative, it’s essential to be aware of impermanent loss – a phenomenon where providing liquidity in volatile assets might result in less value than simply holding the two assets independently.

DeFi Lending

Another popular yield farming strategy is DeFi lending. Unlike traditional finance, where intermediaries are involved, DeFi lending operates in a peer-to-peer manner. Platforms like Compound and Aave let users lend their assets, earning interest over time. Borrowers, on the other hand, provide collateral to secure their borrowed funds, often in excess of the borrowed amount.

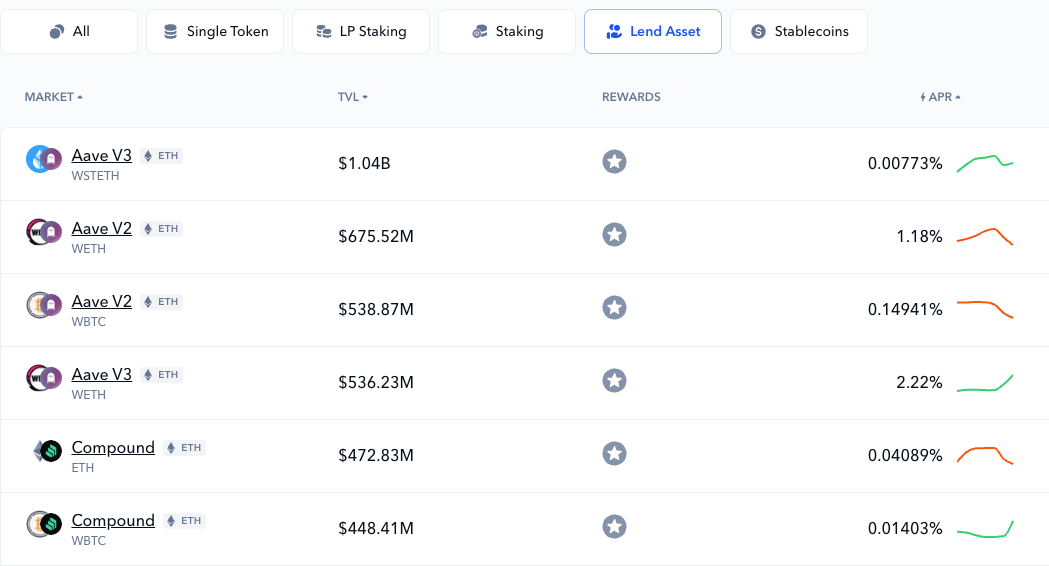

Explore tool Lend Asset filter

Interest rates are dynamically adjusted based on supply and demand. From the perspective of staking vs farming, DeFi lending is purely about farming, as there is no involvement in network security.

Proof-of-Stake Staking

Again, it’s important to remember that the act of proof-of-stake staking falls under the category of yield farming. We’ll dive more into the different complexities of proof-of-stake networks in our next section, but for now, the general outline you should know is this:

Under proof-of-stake, validators lock tokens into smart contracts as a way of showing their good faith towards the network. They are then allowed to participate in the network’s consensus process, receiving rewards that are automatically paid out with tokens for completing transaction relay/verification tasks. Should they fail in these tasks, other participants on the network may “slash” their stake that is locked. This is the mechanism that keeps actors on the network honest.

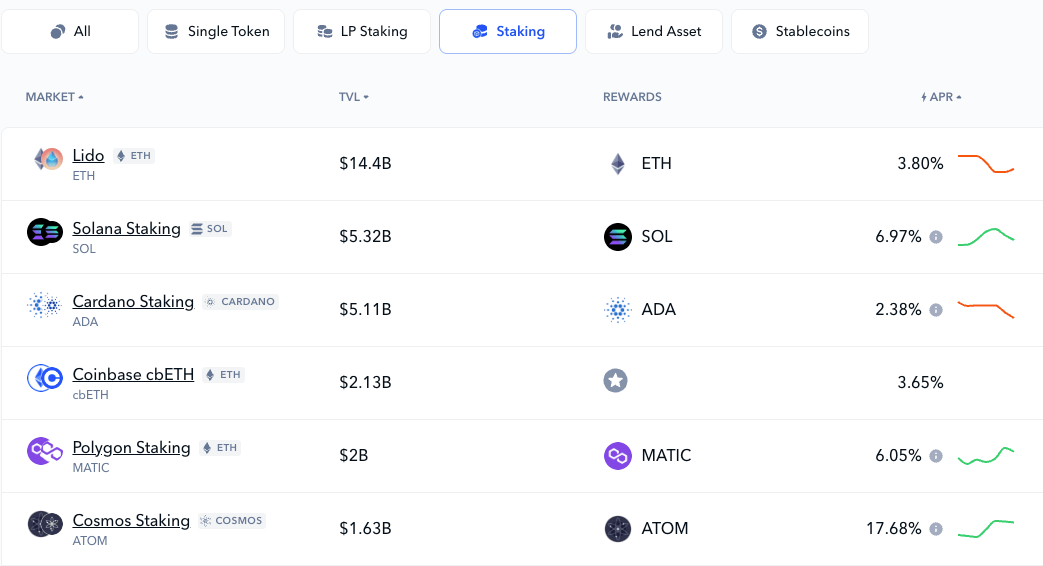

Explore tool Proof-of-Stake filter

Each of these yield farming methods comes with its own risk and reward profile. Whether you’re looking at liquidity pools vs staking or comparing staking vs farming in general, due diligence and thorough research are paramount. As the DeFi landscape evolves, so do these farming methods, offering a dynamic yet rewarding experience for those involved.

Examples of Proof-of-Stake Networks

Within the cryptocurrency industry, proof-of-stake (PoS) has emerged as a prominent alternative to energy-intensive proof-of-work (PoW) systems over the past 5 years.

Understanding the intricacies between these networks and how they work is key to making any decisions regarding investment decisions between proof-of-stake staking vs other types of yield farming. Here are summaries of four major PoS networks:

Ethereum Proof-of-Stake

Overview: Ethereum, originally launched as a PoW network, transitioned to a PoS on September 15th, 2022 via an event known as The Merge. This transition was part of Ethereum’s long-term vision for scalability, security, and sustainability.

Functioning: In the new PoS system, validators replace miners. Validators are required to lock up (or “stake”) at least 32 ETH as collateral. These validators are then chosen at random to propose and attest new blocks. The higher the number of 32 ETH validators controlled by an operator, the more likely they are to be chosen.

Advantages: The move to PoS has drastically reduced Ethereum’s energy consumption. Furthermore, it has allowed many network participants to take a more active role in controlling the protocol since staking is generally considered to be a more accessible task than mining. Ethereum is a cornerstone of discussions regarding staking vs more complex forms of yield farming because it is considered by many to be the lowest-risk yield in DeFi. This is thanks to the network’s long history of resilience.

Staking Yields: The current APR for an Ethereum staker averages ~4% based on data from Ethereum.org.

Solana Proof-of-Stake

Overview: Solana is a high-performance blockchain platform known for its scalability and low transaction costs. It uses a unique hybrid consensus mechanism with PoS supported by a special innovation called proof-of-history (PoH) that allows for faster validation times.

Functioning: Validators on the Solana network produce blocks and process transactions in a sequential manner, thanks to PoH. This allows for greater scalability and throughput. PoS is then layered on top for added security. Validators are chosen based on the amount of SOL tokens they stake.

Advantages: Solana’s combination of PoH with PoS offers high-speed transactions (reportedly over 50,000 transactions per second) without compromising on decentralization or security.

Staking Yields: The current APR for Solana staking is ~6% based on our De.Fi Explore yield farming data app.

Cardano Delegated Proof-of-Stake

Overview: Cardano is an L1 that aims to provide a more secure and scalable infrastructure for the development and execution of smart contracts and decentralized applications (dapps). Launched in 2017 by Charles Hoskinson, one of the co-founders of Ethereum, Cardano differentiates itself through a commitment to peer-reviewed scientific research as the foundation for upgrades and developments.

Functioning: Cardano operates using a proof-of-stake consensus algorithm called Ouroboros, which is designed to be more energy-efficient compared to the commonly used proof-of-work algorithms. The protocol is considered to be an example of delegated proof-of-stake (DPoS) because it depends on stake pools. ADA (Cardano’s native token) holders can delegate their stake to these reliable server nodes run by stake pool operators

Advantages: Cardano’s in-protocol endorsement of stake pools ensures that staking participation and reliable yields are available to everyone, no matter their technical experience.

Staking Yields: The current APR for Cardano staking is ~2.4% based on our De.Fi Explore yield farming data app.

Chainlink Proof-of-Stake

Overview: Chainlink, a decentralized oracle network, ensures smart contracts on various blockchains access secure and reliable real-world data. It’s worth noting that while Chainlink uses a form of staking, it isn’t a pure PoS network in the traditional sense. It allows us to review an example where stakers are securing a type of network that isn’t an independent blockchain.

Functioning: Chainlink node operators can choose to stake LINK tokens as collateral, ensuring honest and accurate data provision. If a node operator fails to deliver accurate data, a portion of their staked LINK may be slashed. It’s a mechanism to ensure data integrity.

Advantages: By using staking, Chainlink ensures its decentralized oracle network remains trustworthy. For those involved in farming and staking crypto, Chainlink represents an interesting blend, especially considering it’s built atop Ethereum and uses LINK as collateral.

Staking Yields: The current APR for LINK stakers is ~4.75% according to staking.chain.link.

Understanding the intricacies of these PoS networks offers a clearer perspective on the evolving crypto landscape. As DeFi platforms continue to grow and adapt, the importance of secure and scalable consensus mechanisms like PoS will only continue to grow.

Examples of Simple Staking Rewards

In the thriving world of decentralized finance (DeFi), staking has become one of the primary methods for users to earn passive income. Different from PoS which provides network security, simple staking rewards involve the more basic action of locking up assets to receive returns.

Here’s a closer look at three popular types of staking rewards in the DeFi realm:

Staking Protocol Governance Tokens for Rewards

Overview: Many DeFi platforms have native governance tokens. Staking these tokens often grants users voting rights in protocol governance and, in return, offers rewards. This method encourages the community’s active participation and enhances protocol security.

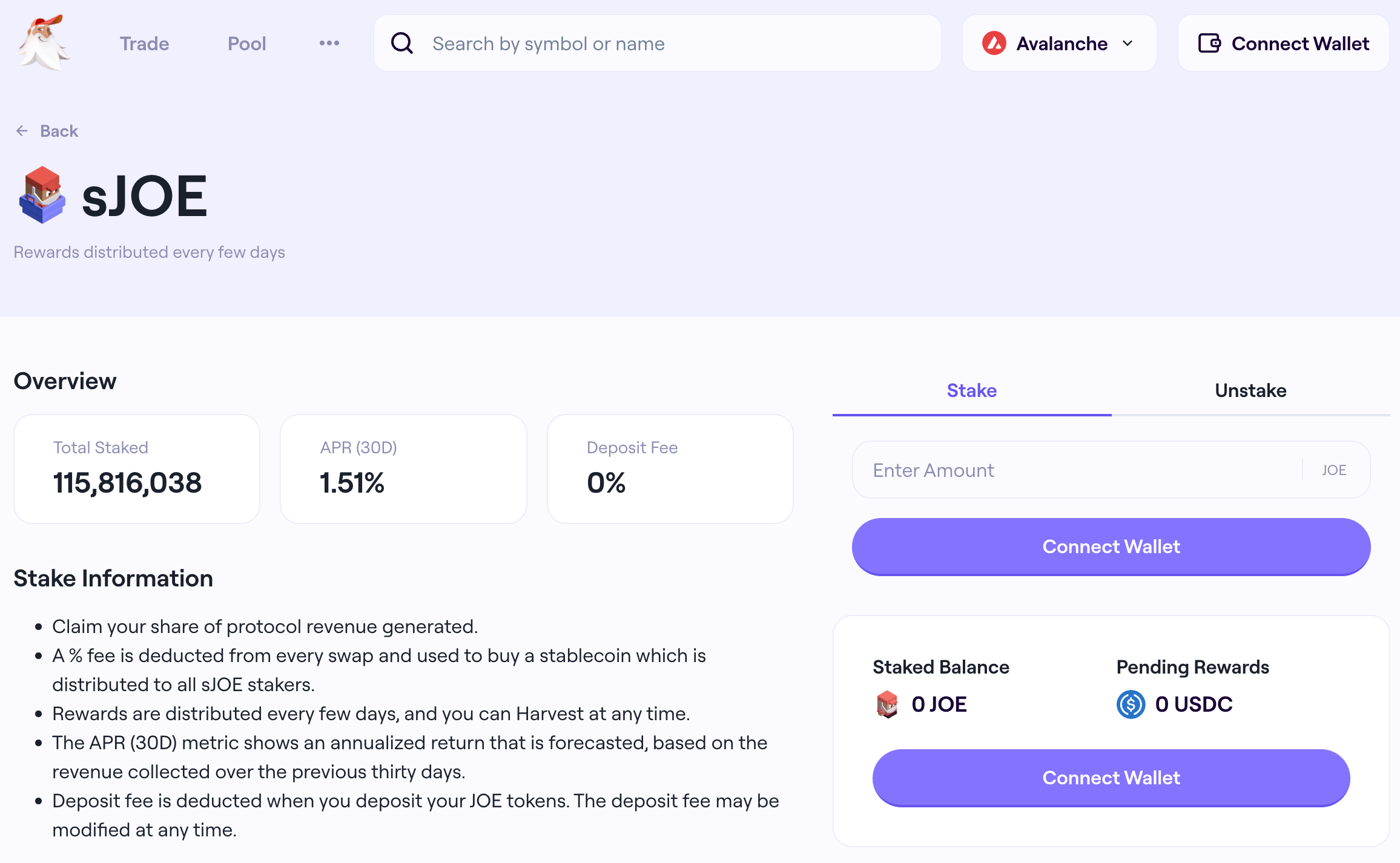

Example – JOE Staking: By staking JOE tokens into sJOE, users earn a real yield in the form of USDC stablecoins. This yield is non-dilutive and solely arises from the trading fees generated by the platform. For every transaction on TraderJoe, a swap fee is imposed.

From these fees, a designated portion, termed ‘Protocol Fees,’ is allocated to sJOE stakers. In essence, sJOE offers a tangible avenue for JOE token holders to derive value from the platform’s trading activities.

Trader Joe offers a simple interface for sJOE stakers

This staking mechanism not only incentivizes holding but also fosters a sense of community ownership and participation. With the potential to earn a steady stream of USDC rewards, it makes a compelling case for those keen on maximizing their DeFi investments.

Benefits: Beyond passive income, staking governance tokens like JOE can also give holders a say in the platform’s future development, strategy, and updates, effectively decentralizing decision-making.

Single Coin Staking for DeFi

Overview: One of the most straightforward staking methods in DeFi involves locking up a single type of cryptocurrency in a protocol to earn interest. Unlike liquidity pools, where users supply two assets, single coin staking is less complex and usually involves less risk.

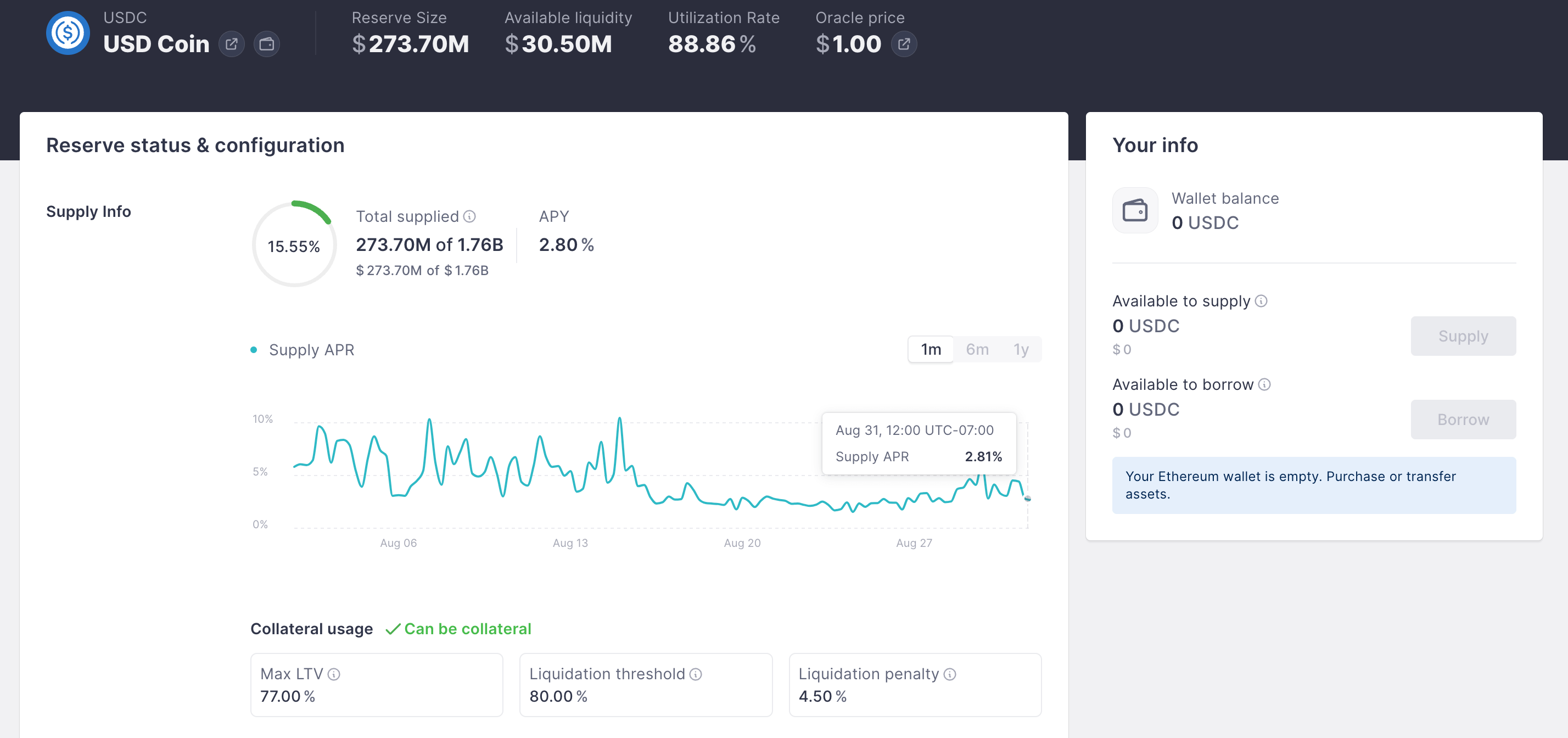

Example – USDC on AAVE: AAVE, a leading DeFi lending platform, allows users to stake stablecoins like USDC. By depositing USDC into the AAVE protocol, users can earn interest, which accumulates over time. This interest is generated from borrowers who take out loans against the staked assets.

AAVE USDC interface

Benefits: Single coin staking, especially with stablecoins, offers a less volatile way to earn in the DeFi space. It’s ideal for those who want to dip their toes into yield farming without dealing with the complexities and risks of yield farming.

NFT Staking

Overview: A recent innovation in the DeFi space, NFT staking, allows users to stake Non-Fungible Tokens (NFTs) to earn rewards. Given the uniqueness of each NFT, this form of staking often involves unique mechanisms and rewards.

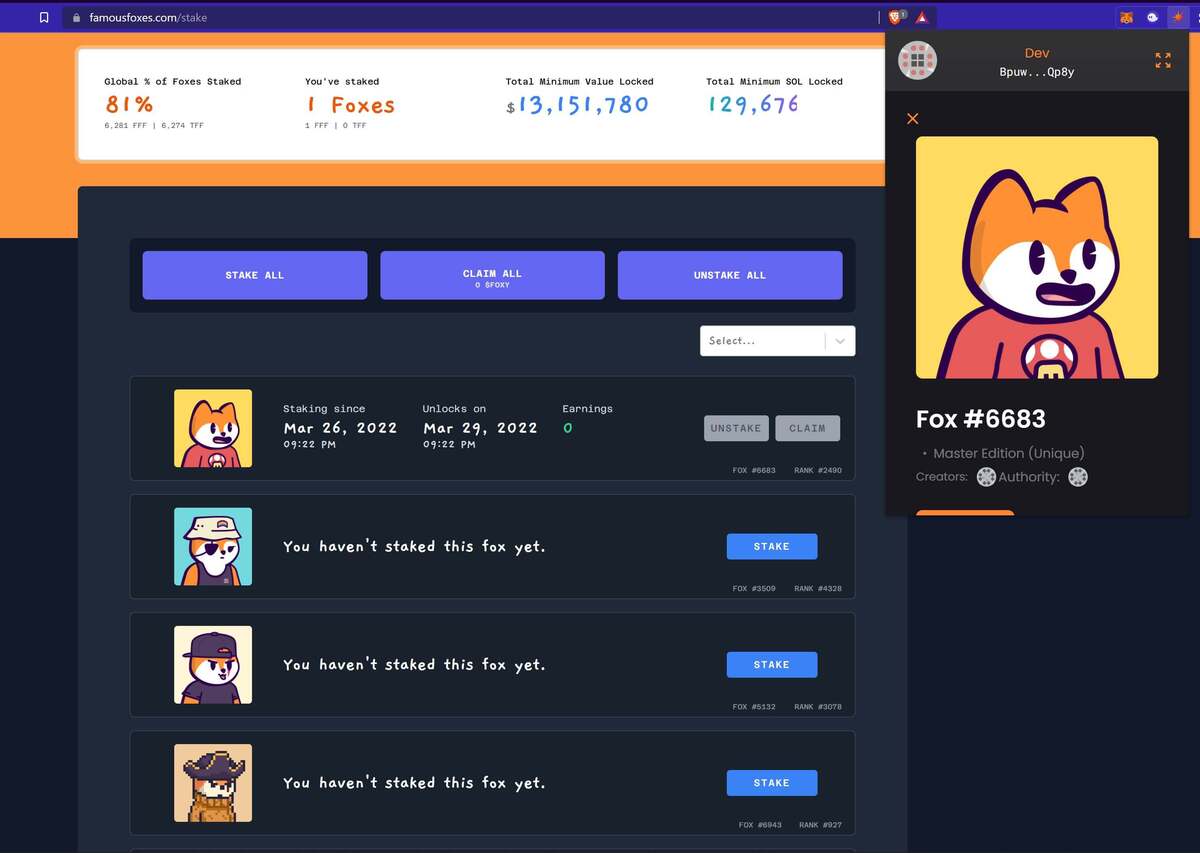

Example – FamousFoxes: The FamousFoxes platform offers an intriguing staking model where users can stake their NFTs to earn FOXY tokens. Each NFT’s rarity and attributes can influence the staking rewards, adding an element of gamification. Over time, as users accumulate FOXY tokens, they can use them in various platform features or trade them.

Benefits: NFT staking merges the worlds of DeFi and digital art/collectibles. It adds utility to NFTs beyond mere collectability or art appreciation, giving NFT holders new ways to monetize their assets.

In summary, the DeFi space’s dynamism offers multiple avenues for users to stake and earn. From staking governance tokens like JOE to single coin staking on platforms like AAVE or venturing into the exciting world of NFT staking, opportunities abound for both novices and seasoned crypto enthusiasts.

What is Liquid Staking?

Liquid staking is a relatively recent concept in the domain of decentralized finance, and it aims to combine the best of both staking and yield farming. In traditional staking, participants lock up their assets in a contract to help secure a network or earn rewards. However, this action often renders the assets illiquid, meaning they can’t be easily moved or used until the staking period concludes.

Enter liquid staking. It offers a solution to the liquidity dilemma by allowing users to stake their assets and, in return, receive a token that represents their staked amount. This token, often referred to as a liquid staking token, can be traded, used in other DeFi protocols, or even as collateral. In essence, liquid staking provides the rewards associated with staking without sacrificing liquidity.

.png)

.png)