How to Invest in DeFi: A Comprehensive Guide

Biggest DeFi Apps

1. Uniswap

If you have been in the DeFi space since its early days, Uniswap should be no stranger to you. Uniswap is a leading decentralized exchange (DEX) that facilitates the swapping of various cryptocurrencies without the need for a central intermediary. It operates on an automated liquidity protocol, meaning that liquidity is provided by users who deposit their funds into pools.

In Uniswap, each token pair has its own pool, and prices are determined using a constant product formula. This model allows for automatic and permissionless trading. Users who provide liquidity to these pools earn a portion of the trading fees generated in proportion to their share of the pool’s total liquidity, incentivizing participation.

2. MakerDAO

MakerDAO primarily revolves around two tokens: MKR and DAI. MKR is the governance token, allowing holders to vote on key protocol decisions. DAI is a stablecoin whose value is pegged to the US dollar, designed to maintain low volatility compared to other cryptocurrencies. The MakerDAO system allows users to lock their cryptocurrency (like Ethereum) in a smart contract to generate DAI.

This process, known as ‘opening a Vault,’ enables users to borrow DAI against their crypto collateral. The value of DAI is kept stable through a dynamic system of Collateralized Debt Positions (CDPs), autonomous feedback mechanisms, and incentivized external actors. If the value of the collateral falls below a certain threshold, the system automatically liquidates it to ensure the stability of DAI.

3. Aave

Aave is a decentralized lending and borrowing platform that stands out for its wide range of supported ecosystems. It operates as a non-custodial protocol, meaning that users retain control of their assets when interacting with the platform. Users can deposit cryptocurrencies into Aave’s liquidity pools to earn interest or borrow against their deposits.

One of Aave’s notable features is the introduction of ‘flash loans’ – these are massive loans that do not require collateral but must be borrowed and repaid within the same blockchain transaction. This unique feature has opened new possibilities in the DeFi space, such as arbitrage, collateral swapping, and self-liquidation. At the same time, this flash loan feature has posed risks to vulnerable smart contracts, with these loans usually being used to drain a protocol of funds.

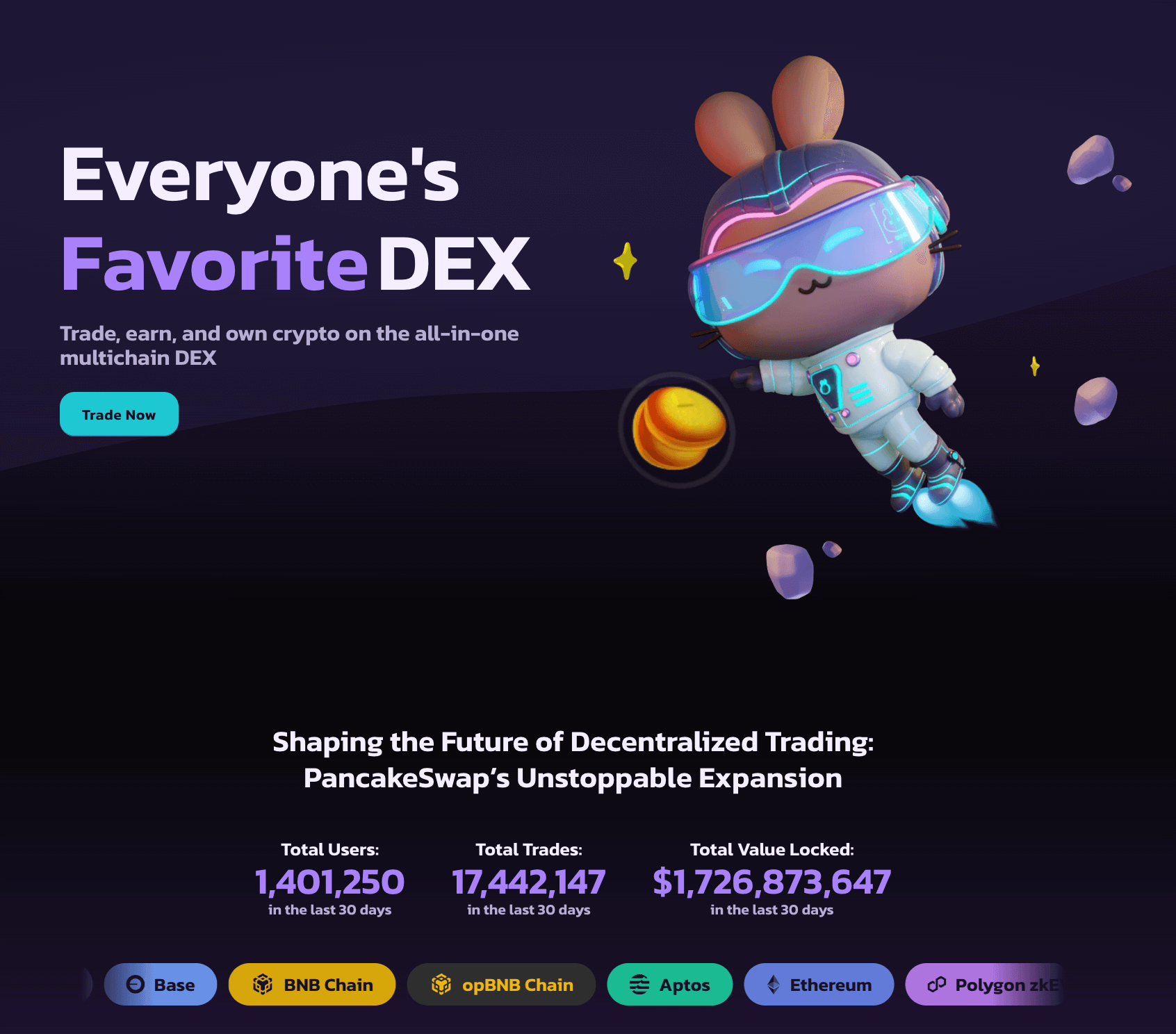

4. PancakeSwap

PancakeSwap, similar in functionality to Uniswap, was originally launched on the Binance Smart Chain (BNB Chain), powered by the BNB token. It offers lower transaction fees and faster transaction speeds due to the efficiency of the BNB Chain. Users can swap between a wide variety of tokens, provide liquidity to earn rewards, and participate in other DeFi activities like yield farming and lotteries. PancakeSwap also features a user-friendly interface and additional gamification elements, making it a popular choice among DeFi enthusiasts.

In addition to being an Automated Market Maker (AMM) DEX like Uniswap, PancakeSwap also features perpetual swap markets, allowing you to trade with leverage, and potentially amplifying your gains. Since its launch on the BNB chain, it has since expanded to new ecosystems like Arbitrum, Ethereum, Base, ZkSync, Linea zkEVM, and others.

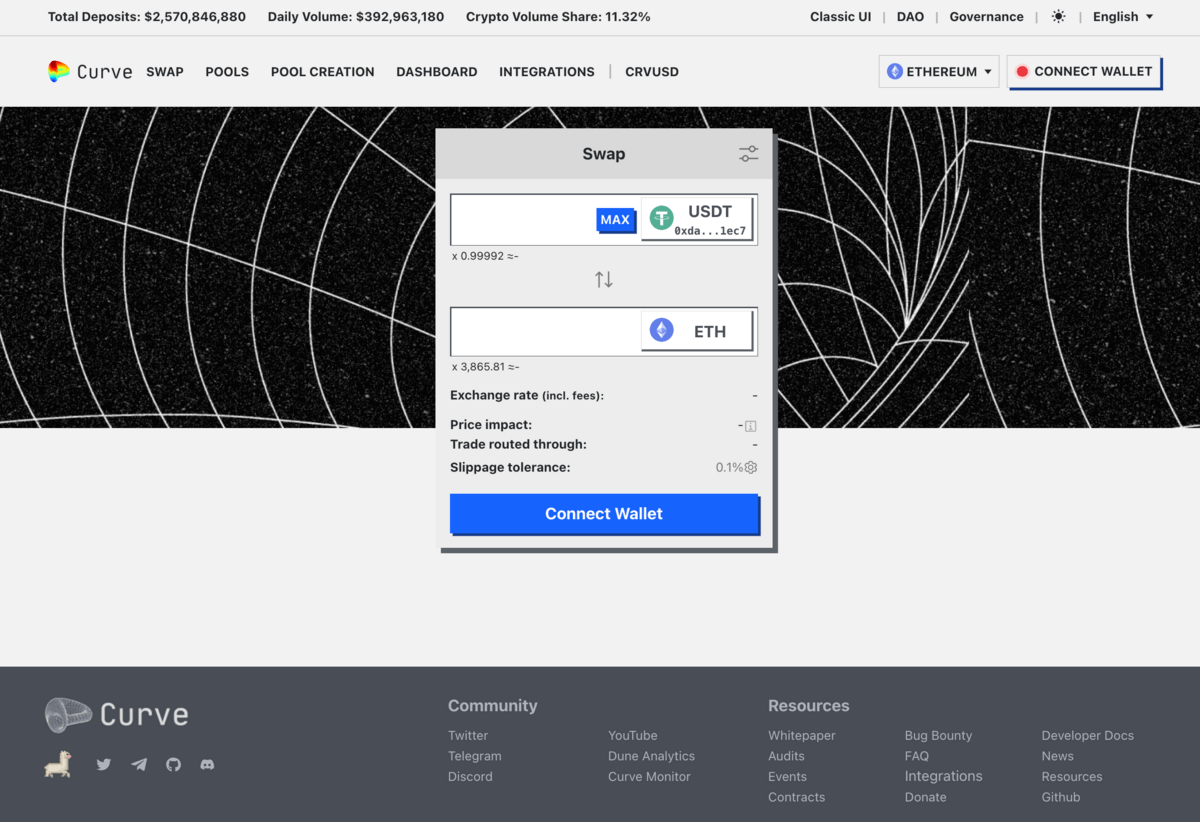

5. Curve

Curve is a DEX that specializes in the trading of stablecoins. It addresses one of the main issues in stablecoin trading: slippage. Slippage often occurs in trades between different cryptocurrencies due to price volatility. Curve uses a unique automated market maker (AMM) algorithm designed for stablecoins, which are generally pegged to a specific value (like the US dollar).

This specialization allows Curve to offer low slippage and minimal price disparity, therefore making it the most efficient place to switch between stablecoin types. Furthermore, Curve’s liquidity pools are optimized for stablecoin yields, enabling efficient and stable trades.

How to Invest in DeFi

Understanding the DeFi Ecosystem

First and foremost, it’s essential to have a solid understanding of what DeFi is and how it operates. This involves familiarizing yourself with the underlying blockchain technology, smart contracts, and how these platforms facilitate financial services like lending, borrowing, staking, and liquidity provision. Check out our guide to De.Fi’s DeFi tools to learn the essentials.

Utilizing Information Platforms

Leveraging information-rich platforms such as X, YouTube, and Reddit is invaluable. These platforms host a plethora of community discussions, expert analyses, and project updates. Following influencers and thought leaders in the DeFi space can provide insights into market trends, emerging projects, and potential red flags. Follow De.Fi on X via our main profile and De.Fi Security account to stay on top of the latest trends.

Deep Dive Into Projects

When a particular DeFi project catches your interest, it’s crucial to delve deep into its specifics. This includes understanding the project’s purpose, the problem it aims to solve, the team behind it, and its roadmap. Reading the project’s whitepaper and official documentation provides a clear picture of its mechanism, tokenomics, and long-term viability.

Evaluating Security With De.Fi’s Tools

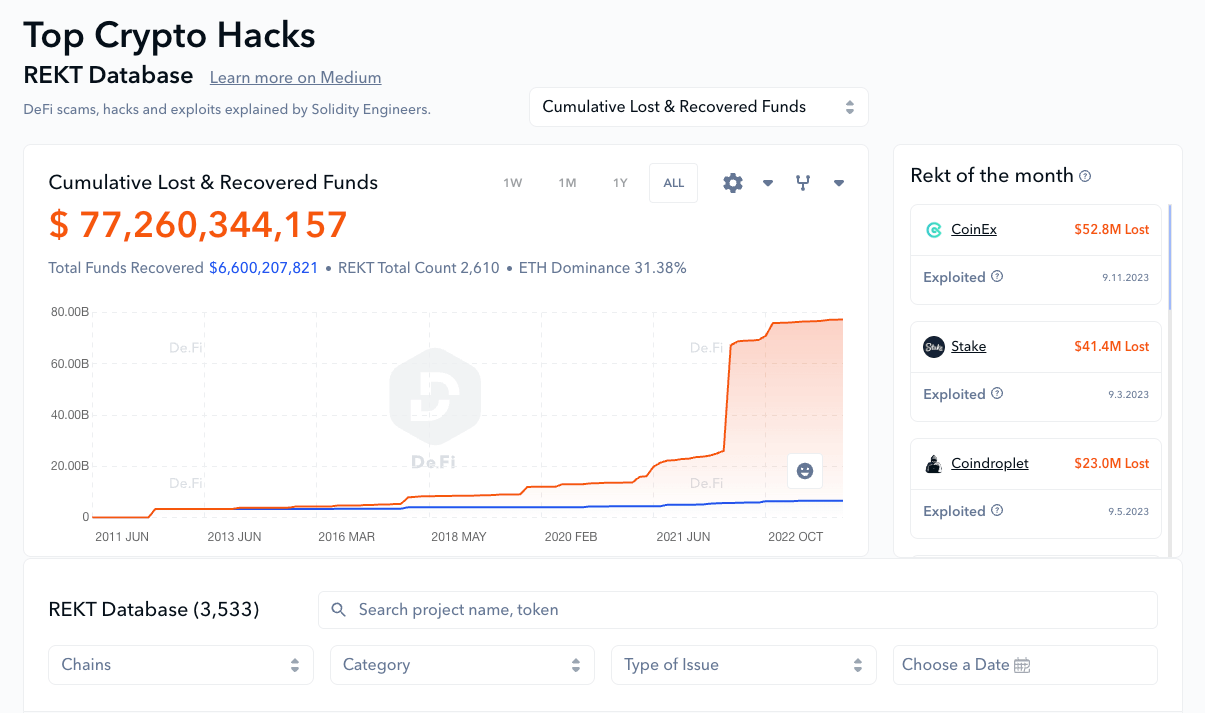

De.Fi’s REKT Database allows you to stay safe by learning from the mistakes of previous projects

Security is paramount in DeFi. Tools like De.Fi’s DeFi Scanner and Audit Database are essential for assessing the security posture of a project. These tools can reveal past vulnerabilities, the quality of smart contract audits, and the overall robustness of the platform’s security measures.

Assessing the Blockchain Network

The blockchain network on which a DeFi project operates is a critical factor. Different blockchains have varying degrees of security, transaction speed, and costs.

For instance, projects on Ethereum might offer more security but at higher transaction fees, while those on newer blockchains like BNB Chain or Solana might offer lower fees but with different trade-offs in terms of security and decentralization.

Tokenomics and Incentive Structures

Understanding a project’s tokenomics is vital. This includes how tokens are distributed, their total supply, and how they are used within the ecosystem. Look for projects with sustainable token models that incentivize long-term holding and contribute to the ecosystem’s health.

Community and Developer Activity

A strong, active community and developer presence is a positive indicator of a project’s health. Active development, frequent updates, and community engagement are signs of a project’s commitment to growth and responsiveness to user needs.

Follow De.Fi on X for updates on the latest news

Regulatory Landscape

Considering the regulatory environment of DeFi is also important. Different jurisdictions have varying stances on cryptocurrencies and DeFi, which can impact the project’s operations and your ability to participate legally.

Performance Metrics and Historical Data

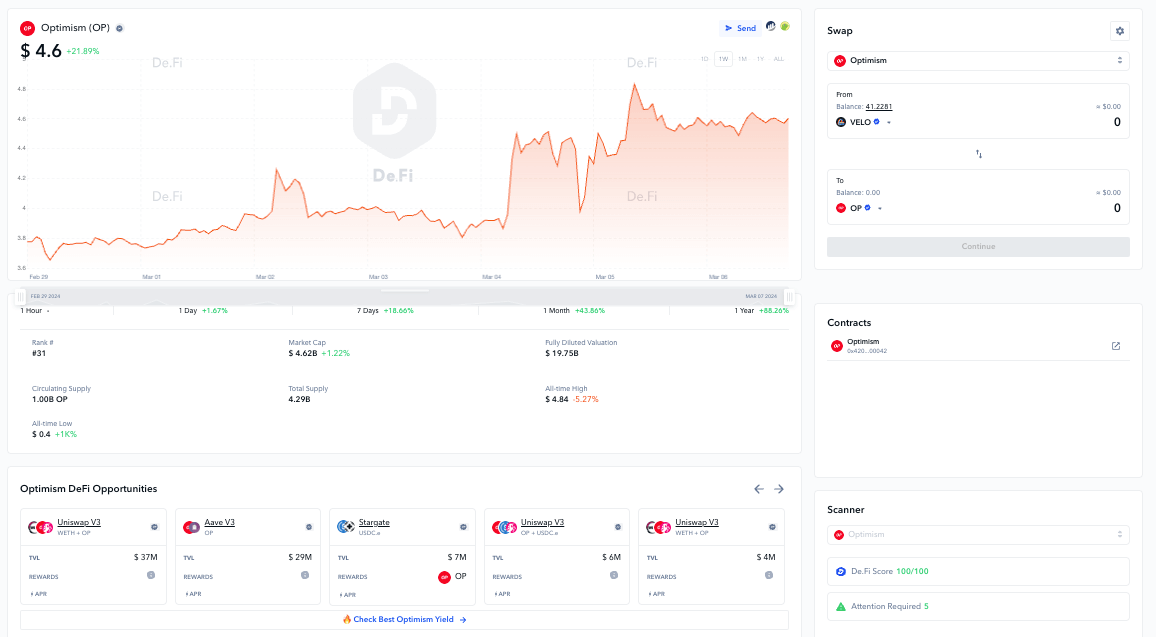

Analyze the project’s performance metrics such as total value locked (TVL), liquidity, trading volumes, and historical price data. This data can offer insights into the project’s stability and user adoption.

De.Fi’s token market pages allow you to research historical data regarding different coins (Optimism page shown above)

Risk Management

Finally, it’s crucial to understand and manage the risks associated with DeFi investments. This includes the risk of smart contract vulnerabilities, regulatory changes, market volatility, and liquidity issues. Diversifying your DeFi portfolio can mitigate some of these risks.

Researching DeFi investments involves a multifaceted approach. It requires technical understanding, security assessment, economic analysis, and active engagement with the community and ongoing developments. By thoroughly vetting potential investments using these criteria, investors can make more informed decisions and navigate the DeFi space with greater confidence.

Choose a DeFi Wallet

When entering the world of DeFi investments, one of the most critical decisions involves selecting the right wallet. A DeFi wallet not only stores your digital assets but also acts as your gateway to various DeFi platforms. The choice between software (hot) wallets and hardware (cold) wallets, along with understanding the leading options in the market, is key to making an informed decision.

Software vs. Hardware Wallets

Software Wallets

Pros: Software wallets, such as MetaMask, Trust Wallet, and Coinbase Wallet, are applications that can be easily installed on your devices. They offer quick access to DeFi platforms and are generally user-friendly. These wallets are ideal for active traders and those who need regular access to their assets.

Cons: Being online, they are more susceptible to hacks, phishing attacks, and malware. The security of your assets in a software wallet largely depends on the security of your device and internet connection.

Hardware Wallets

Pros: Hardware wallets, like Ledger Nano X or Trezor, provide enhanced security. They store your private keys offline, making them immune to online hacking attempts. For long-term investors or those with substantial holdings in DeFi, a hardware wallet is often the preferred choice.

Cons: They can be less convenient for frequent trading or accessing funds quickly. Also, there is a risk of physical damage or loss, and they typically come with a cost. Finally, having a hardware wallet does not protect you from user error, such as approving a phishing contract therefore, vigilance is still required.

Leading DeFi Wallets

1. MetaMask

A popular Ethereum-based wallet, MetaMask is known for its ease of use and integration with most DeFi platforms. It’s a browser extension that also has a mobile app, making it accessible across devices. It supports pretty much every EVM network and is thus a must-have if you’d like to hold funds in the Ethereum ecosystem or any of its Layer 2s.

2. Trust Wallet

Acquired by Binance, Trust Wallet supports a wide range of cryptocurrencies and is known for its user-friendly interface. It allows users to store multiple cryptocurrencies and interact with various blockchains. Similarly to MetaMask, it supports EVM chains but also adds support for Solana, Bitcoin, Cardano, and XRP.

De.Fi Trust Wallet Safety Guide

3. Coinbase Wallet

Separate from the Coinbase exchange, the Coinbase Wallet is a mobile app that provides access to a wide variety of DeFi applications. It’s known for its security and ease of use, making it suitable for beginners.

De.Fi Coinbase Wallet Safety Guide

4. Ledger Nano X

A leading hardware wallet, Ledger offers robust security by storing private keys offline. It supports multiple cryptocurrencies and allows users to securely manage their assets. This can be used in tandem with wallets like Trust or MetaMask in order to access DeFi apps and approve transactions.

De.Fi DeFi Hardware Wallet Guide

5. Trezor

.png)

.png)